income tax plus capital gains tax

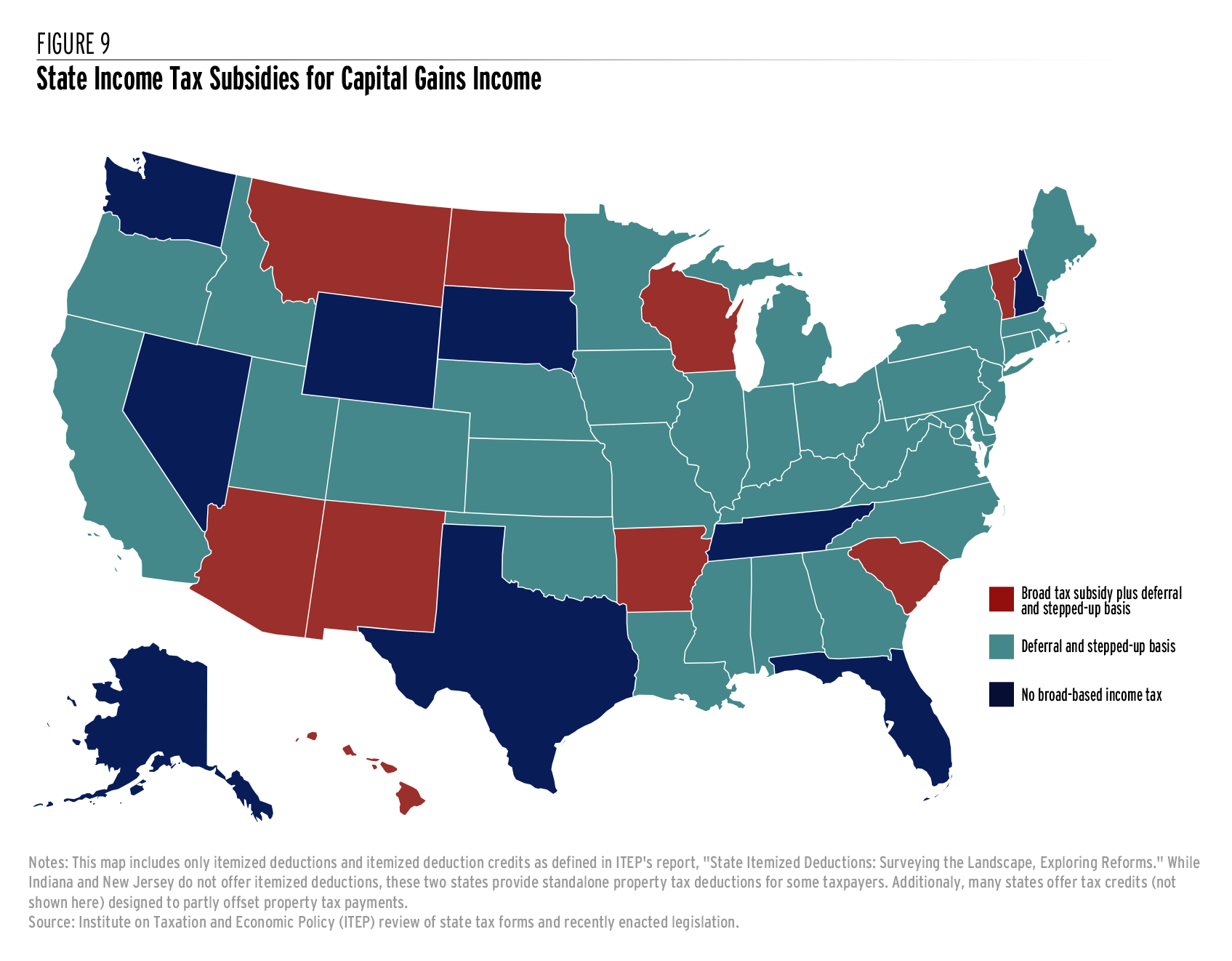

Since you have income from both salary and capital gains you have to file ITR-2. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

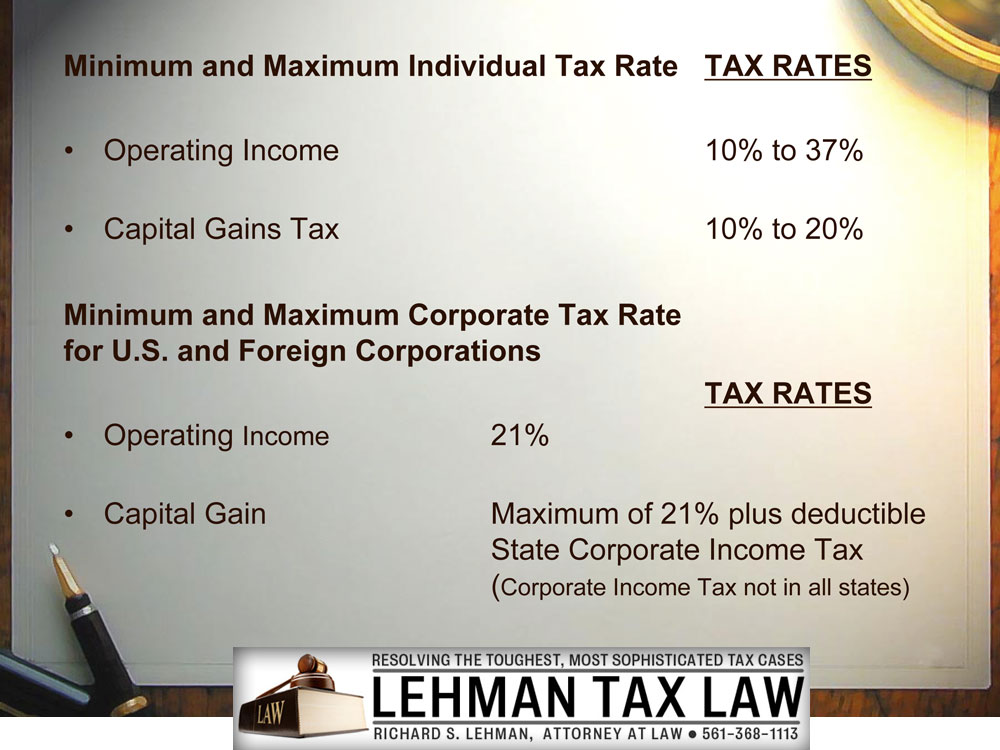

U S Capital Gains Tax For Foreign Investors United States Taxation Of Foreign Investors With Richard S Lehman Tax Attorney

Form 11 Form 1 or Form CT1.

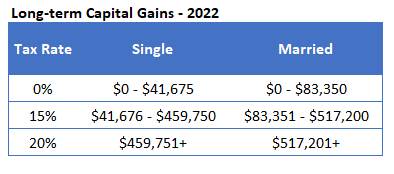

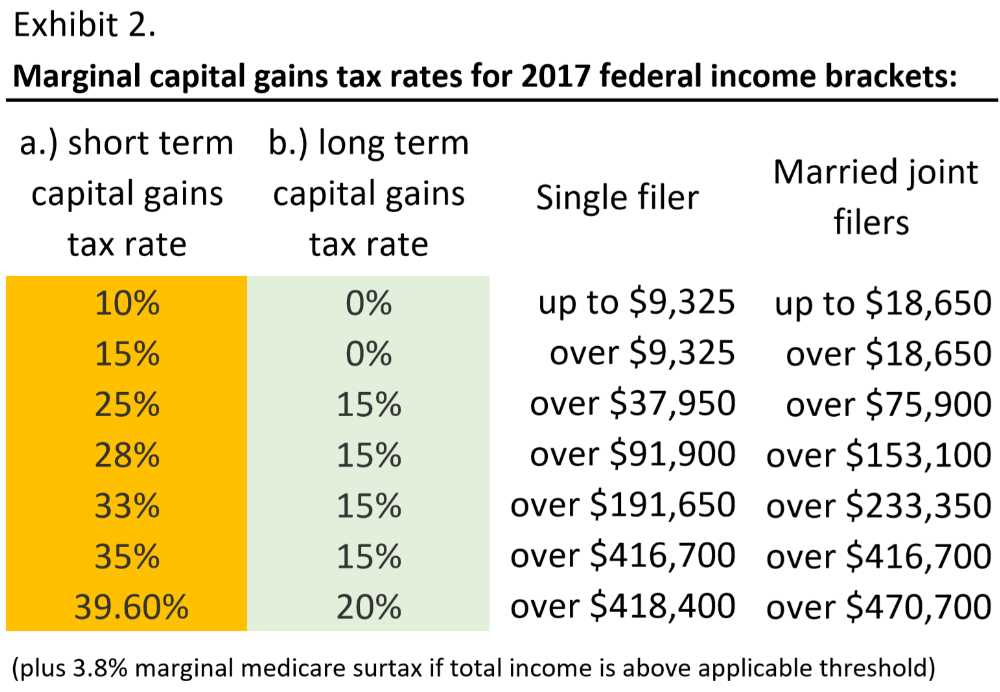

. Long-term more than one year capital gains are taxed based on your. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. For these purposes high.

Joe Taxpayer earned 35000 in 2022. You can post the Form CG1 or Income Tax Return Form 12 to. He pays 10 on the first 10275 income anIf Joe sells an asset that produced a short-term capital gain of 1000 then his tThe IRS separates taxable income into two main categories.

The Capital Gains Tax rates and allowances for 2022 are. In the tax year 2020 to 2021 the total estimated tax gap for Income Tax National Insurance contributions NICs and Capital Gains Tax is 34 of total theoretical liabilities. HR Block was wrong or you are misinterpreting what they did.

The FEIE operates to subtract out the. Currently long-term capital gains are in general taxed at 20. Ordinary income anThe most important thing to understand is that long-term realized capit See more.

The term net capital gain means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. What is capital gains tax. You can claim standard deduction in ITR-2 from salary up to a maximum of Rs 50000.

The NIIT applies a 38 surtax on investment income including interest dividends capital gains and rent and royalty income for high-income taxpayers. Income Tax Plus Capital Gains Tax. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

The tax rate you pay on your capital gains depends in part on how long you hold the. Exactly how much CGT someone has to pay depends on how much they earn and pay in income tax. The term net long.

Short-term capital gains are taxed as ordinary income at rates up to 37 percent. Capital gains tax CGT is not a separate tax but forms part of income tax. Tax rates are the same for every.

Another example Single total taxable income is 80K with regular. If you decide to sell youd now have 14 in realized capital gains. For 2022 you may qualify for the 0 long-term capital gains rate with taxable income of 41675 or less for single filers and 83350 or less for married couples filing jointly.

Plus regular tax on 30K is the total tax liability. Capital Gains Tax plus Income tax Capital Gains allowance 12300 Personal income allowance 12570. Capital gain 15 20000 - 10400 15 1440 tax.

A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Now to your tax bill.

Taxpayers with modified adjusted gross income. Capital Gains Tax is charged on the capital gain or profit made on the disposal of an asset. Long-term capital gains tax in the case of equities is 10 if the total gain in a financial year exceeds Rs 1 lakh.

Long-term gains are taxed at lower rates up to 20 percent. You report capital gains and capital losses in your income tax return and pay. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22.

Short-term less than one year capital gains are taxed at your regular income tax rate. FEIE of -70K suggests you had 70K if foreign earned income and 15K of capital gains. If your taxable income was 45000 and youre filing as a single person youd pay tax at a rate of 22 on that 2000 in gains for a total tax bill of 440 on your short-term gains.

How Will My Capital Gains Be Taxed

Capital Gains Taxation Bracket Rates 2019 Strategy Guide

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

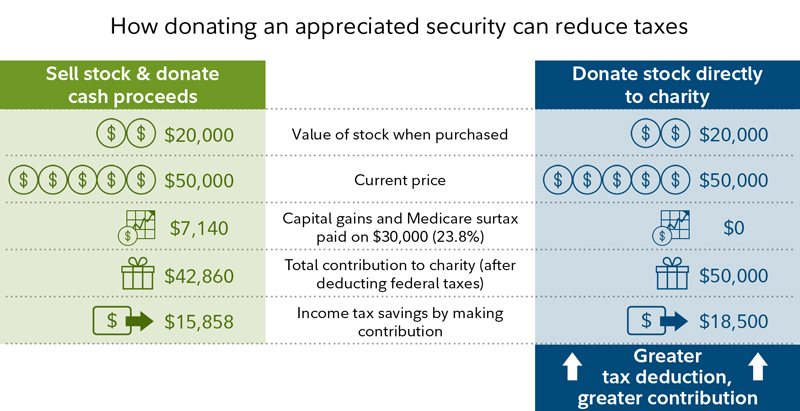

Charitable Giving And Taxes Fidelity

2021 Capital Gains Tax Rates By State

An Overview Of Capital Gains Taxes Tax Foundation

Can Capital Gains Push Me Into A Higher Tax Bracket Quarry Hill Advisors

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Capital Gains Tax What Is It When Do You Pay It

State Individual Income Tax Rates And Brackets Tax Foundation

Real Estate Tax Benefits The Ultimate Guide

Capital Gains Tax Plus Income Tax R Ukpersonalfinance

Investment Income Taxes Schwab

2022 Income Tax Brackets And The New Ideal Income

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate